Have you wondered why the stock market has been so choppy since October and why crypto and gold keep flash crashing? The western media would have you believe this is due to AI bubble, war in Greenland, and Trump's tweets. We have a better story to tell.

Wall Street has lost control of the Japanese Yen carry trade unwind.

There's been a fair bit of quiet chaos in financial markets recently. Cryptocurrencies have lost 40% of their value. We saw silver drop 40% which hasn't happened since 1980. Stocks like Microsoft are getting picked off one-by-one with 15% drops when positive earnings reports come out. Meanwhile the broader market chops sideways, so people think things are fine. Trump and Europe were on the brink of war for control of a desolate arctic territory. Truth Social has overtaken FOMC as the most important source of financial news. These things may all appear to the untrained eye as a series of idiosyncratic, disconnected shocks. The prevailing media narrative is that the market is reacting negatively to AI CapEx spending and a hawkish new Fed chair. But our systematic analysis of cross-asset flows, derivatives positioning, central bank policy minutes, and institutional balance sheets suggests a singular, unified causality that binds these disparate anomalies, which is the covert unwinding of the Japanese Yen carry trade.

For nearly thirty years, the Bank of Japan’s (BOJ) Zero Interest Rate Policy (ZIRP) and subsequent Negative Interest Rate Policy (NIRP) effectively transformed the Yen into the world’s funding currency. We would call it the greatest free money printer ever made. By anchoring borrowing costs at or near zero, the BOJ enabled Wall Street to borrow Yen cheaply and invest it with leverage into higher yielding instruments globally, such as U.S. treasuries, equities, and cryptography. For example, you borrow Yen from Japan at 0% interest, you exchange it for USD, and then you buy treasury bonds that pay 4%. It's that simple. This funded government benefits and provided continuous reliable liquidity for financial markets that made stocks keep going up while suppressing volatility.

Trillions of dollars of free loans from the Bank of Japan were used by a generation of investors to buy a double digit percentage of the U.S. economy. Now those loans are being recalled. Wall Street traders who levered up on the free Japanese money now have to sell trillions of assets and convert the proceeds back to Yen in order to not be liquidated. These aren't happy times for them. They get liquidated when Japan raises interest rates; they get liquidated when the Federal Reserve lowers interest rates; they get liquidated when the Japanese Yen increases in value; they get liquidated when tech stocks aren't going up enough, and all four of these things have been happening at once.

Wall Street may be greedy, but they're very intelligent too. They made many smart choices about where to put the "free" money. Now let's say you're someone who's also smart, but was wise enough to not use Sauron's ring. Chances are you invested in the same things as Wall Street. So by now you've probably seen your whole portfolio move against you; you're wondering why your hedges don't work; and you feel like you're being punished for making all the right choices. It's because other smart people, who got greedy, are being forced to close their positions, and you're the whipping boy for their avarice.

The Japanese Yen is sort of like GameStop ($GME). It's the most shorted currency on Earth. When you borrow yen to buy American assets, you're effectively shorting the yen. Currency can be rehypothecated so that yen-denominated debt ends up exceeding the actual yen supply, the same way GME's short interest exceeded 100% of its float. When shorts start covering it compounds tragedy, because they all have to buy yen, which makes its value increase, forcing more shorts to cover, and Japan is a small island.

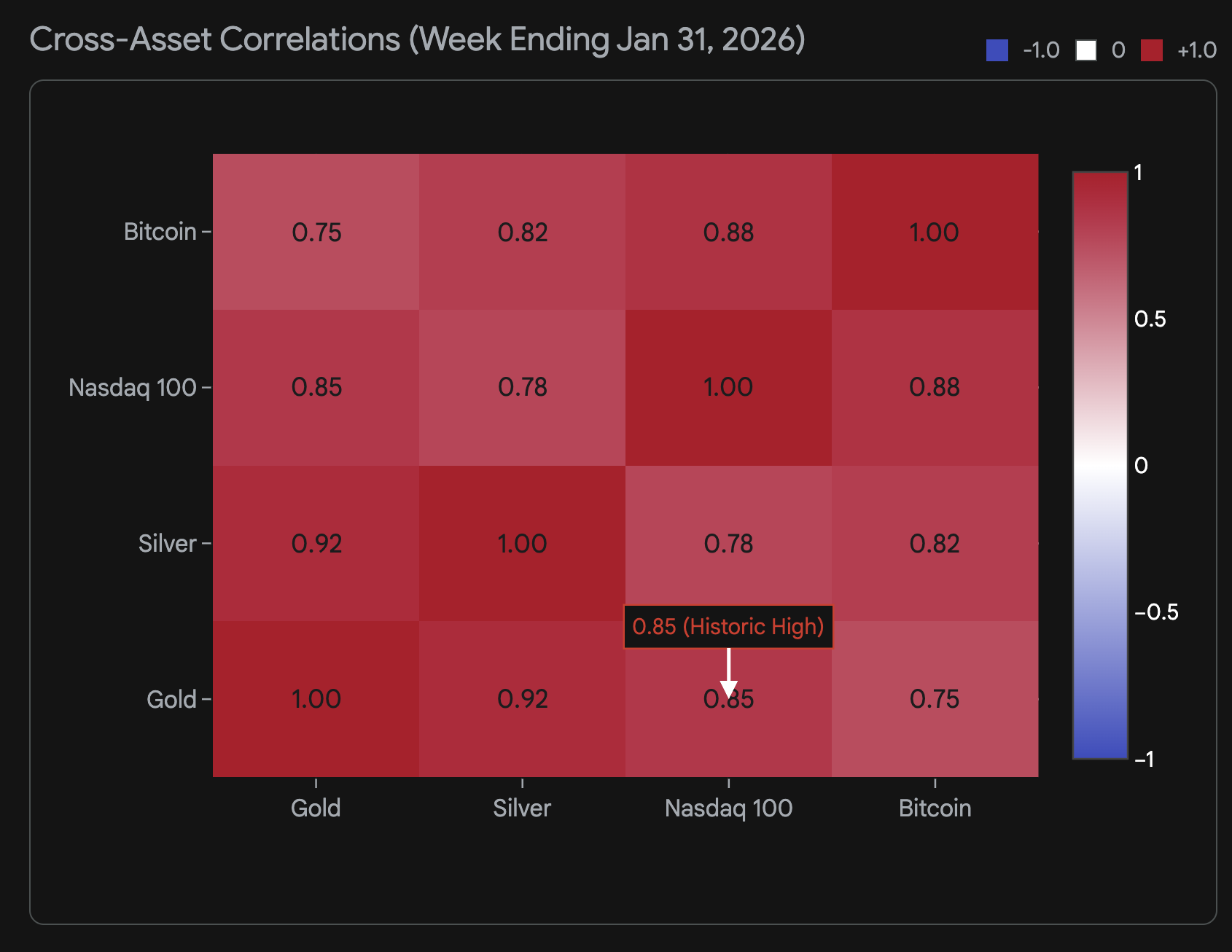

This December 2025 rate hike to 0.75%, followed by the explicitly hawkish signalling from Prime Minister Sanae Takaichi’s administration, has fundamentally altered the risk-reward calculus of these leveraged positions. The market disruptions observed in January 2026 bear the distinct mathematical signature of a forced liquidation event rather than a fundamental repricing of growth prospects. When correlations between historically uncorrelated assets (e.g. Gold, Bitcoin, Microsoft, and Silver) approach 1.0 during a sell-off, it serves as a distinct indicator that traders are not selling what they want to sell, but rather what they must sell in order to meet margin calls in a funding currency that is rapidly appreciating against their liabilities.

We shall investigate the mechanics of this unwind in exhaustive detail. We analyze the "Greenland Distraction" not as a root cause but as a volatility trigger that shattered the complacent calm of the "Davos Consensus." We examine the anomalous liquidation in precious metals following the nomination of Kevin Warsh to the Federal Reserve Chairmanship, and we dissect the flow of funds from major Japanese institutional whales like Norinchukin Bank, whose retreat from foreign bond markets has left a liquidity vacuum in the U.S. Treasury complex. The evidence points to a systemic repricing of the global cost of capital, originating in Tokyo and transmitting violently through the plumbing of Wall Street, leaving no asset class untouched.

To fully comprehend the market chaos of January 2026, one must look beyond the immediate headlines of the new year and scrutinize the subtle yet seismic shifts that occurred in Tokyo during the closing months of 2025. The conventional market narrative has long regarded the Bank of Japan as a passive, almost paralyzed actor, perpetually trapped in a deflationary mire and unable to normalize policy. This view has always been demonstratably false. The truth is that Wall Street leaders have been planning for the next quarter, while the Japanese have been preparing for the next century. The data confirms a deliberate, aggressive shift toward normalization that caught global carry traders offguard.

In a move that many Western analysts critically underestimated, the Policy Board of the Bank of Japan voted unanimously to raise the uncollateralized overnight call rate to 0.75% during its policy session on December 18-19, 2025. While a 25 basis point hike might appear negligible in the context of Federal Reserve or ECB tightening cycles, in the context of the Japanese financial system, which has operated near the zero-bound for decades, it represents a massive tightening of financial conditions.

This move was not merely a technical adjustment; it was a fundamental regime change. Coming from a baseline of -0.1% in early 2024 and 0.50% in late 2025, the move to 0.75% signaled that the era of "free money" had definitively ended. The rationale provided by the BOJ was grounded in shifting inflationary dynamics. Core CPI (excluding fresh food), the central bank's preferred metric, was tracking near 3% in late 2025, persistently exceeding the 2% price stability target.Although inflation eased slightly to 2.4% in December, the BOJ minutes reveal a board convinced that "wage gains may be durable," thus justifying higher rates to prevent a wage-price spiral.

Crucially, the minutes from the December meeting, which were released in late January 2026, contain explicit language suggesting that the tightening cycle is far from complete. The board noted that "real interest rates are expected to remain negative," implying that a policy rate of 0.75% is still considered accommodative relative to inflation.To a bond trader, this is hawkish code. It suggests that the "neutral rate" is significantly higher, potentially between 1.5% and 2.0%. If the market prices in a terminal rate of 2.0%, the cost of funding for carry trades effectively triples from previous levels, turning profitable arbitrage positions into deep losses.

The political dimension in Japan has exacerbated the monetary tightness, creating a "double tightening" effect that algorithms have struggled to price. Prime Minister Sanae Takaichi, preparing for a snap election on February 8, 2026, has adopted a complex economic stance that blends fiscal expansion with monetary discipline, a volatile mix for currency markets.

Takaichi advocates for "strategic fiscal spending" and tax cuts to stimulate the domestic economy. In standard macroeconomic theory, an expansionary fiscal policy (increased government spending) combined with a tightening monetary policy (higher rates to combat the resulting inflation) is the perfect recipe for currency appreciation. While Takaichi has publicly softened her rhetoric to avoid accusations of currency manipulation, stating she "did not have a preference for the yen's direction", her policies speak louder than her soundbites.

The market fears that Takaichi’s proposed fiscal largesse will force the BOJ to hike rates faster than currently projected to counteract the inflationary effects of government spending. This creates a two-front war on the Yen carry trade:

Cost of Funding Rises: Higher BOJ rates make borrowing Yen expensive.

Exchange Rate Risk: If the Yen appreciates due to the fiscal-monetary policy mix, the principal value of the USD-denominated assets held by Japanese investors falls in Yen terms, triggering margin calls.

The tension between the Prime Minister's office and the Ministry of Finance (MOF) adds another layer of uncertainty. Finance Minister Satsuki Katayama has been far less tolerant of currency volatility, repeatedly intervening or threatening intervention when USD/JPY approaches the 155-160 danger zone.This political friction creates a "floor" for the Yen, making shorting the currency a perilous endeavor for global macro funds.

Perhaps the most critical, yet underreported, development is the behavior of Japan's gargantuan institutional investors, specifically Norinchukin Bank (often referred to as the "CLO Whale") and Nippon Life Insurance. These entities have historically been the largest buyers of U.S. debt, recycling Japan's trade surplus into U.S. Treasuries and corporate bonds.

The data indicates a massive reversal in these flows. Following significant losses in 2024 and 2025 due to unhedged exposure to U.S. and European sovereign bonds, Norinchukin has been actively liquidating foreign assets. By the end of December 2025, the bank had unloaded nearly ¥12.8 trillion (approximately $88 billion) in foreign government bonds.The bank’s CEO, Taro Kitabayashi, confirmed the completion of this sell-off, stating the bank would "take its time" before committing capital to fresh investments.

The significance of this cannot be overstated. A major, price-insensitive buyer of U.S. debt has left the building. When the U.S. Treasury issues debt to fund its deficit, Norinchukin is no longer the guaranteed bid. This removal of liquidity support weakens the floor for U.S. Treasuries, contributing to the yield spikes seen in January. Similarly, Nippon Life has signaled a rotation back into domestic Japanese Government Bonds (JGBs), acknowledging that "unrealized losses" on foreign bonds had swelled to ¥4.7 trillion.The logic is simple: why take currency risk for a 4.5% U.S. yield when domestic JGB yields are rising and offer a risk-free return in your home currency?

By December 31, 2025, the stage was set. The "free money" era was over. The largest holders of capital in Tokyo were repatriating funds or moving into cash. Global markets, however, were still positioned for "business as usual", long Nvidia, long Bitcoin, short Yen. The dissonance between Japanese reality and Western positioning created the perfect conditions for a crash.

To validate the thesis that the Yen unwind is the primary driver of volatility, we must examine the sequence of events. The crash did not happen in a vacuum; it followed a precise timeline where geopolitical shocks acted as triggers for a structural fragility that had been building since the BOJ's December pivot.

The pressure began to build in Q4 2025. As the BOJ signaled its intention to hike rates, Japanese traders, often the "canary in the coal mine" for global liquidity, began to reduce risk. This cycle started with Bitcoin. Bitcoin is a pure liquidity asset; it has no yield and is often funded via margin. As the cost of Yen margin rose, Japanese selling pressure on Bitcoin intensified from October through December.This was the first tremor.

Was the "Greenland War" theater? While the military dimensions may have been performative, the economic consequences were tangible and acted as the catalyst that exposed the fragility of the Yen carry trade.

On January 17, 2026, President Trump escalated his demand to purchase Greenland by threatening a 10% tariff on eight European nations (including the UK, Germany, and France) and escalating to 25% by June if the territory was not ceded.This introduced a "tail risk" that markets had not priced: the fracture of the Atlantic economic alliance.

Following the Martin Luther King Jr. holiday, U.S. markets opened on January 20 to a bloodbath. The S&P 500 fell 2.1%, the Nasdaq composite dropped 2.4%, and yields on U.S. Treasuries spiked.The narrative was "Greenland," but the market mechanics told a different story. The threat of tariffs on close allies disrupts the "Atlantic Trade" narrative. For Japanese investors holding U.S. assets, this introduced a new risk premium. It wasn't just about rates anymore; it was about the stability of the U.S.-led global order. This geopolitical volatility forced risk parity funds and algorithmic traders to reduce gross exposure. When a global portfolio deleverages, it buys back its funding currency. In this case, it bought Yen.

While Trump walked back the military threat on January 21 at Davos, the economic threat of tariffs remained a live wire. The volatility persisted, suggesting that the "Greenland" narrative was merely the match that lit the fuse of a much larger powder keg.

The final and most violent phase of the crash occurred at the end of the month, triggered by the nomination of Kevin Warsh as Federal Reserve Chair.Warsh is widely perceived as a hawk, favoring sound money and skepticism toward quantitative easing. His nomination signaled the potential end of the "Fed Put", the assumption that the central bank would always intervene to support asset prices.

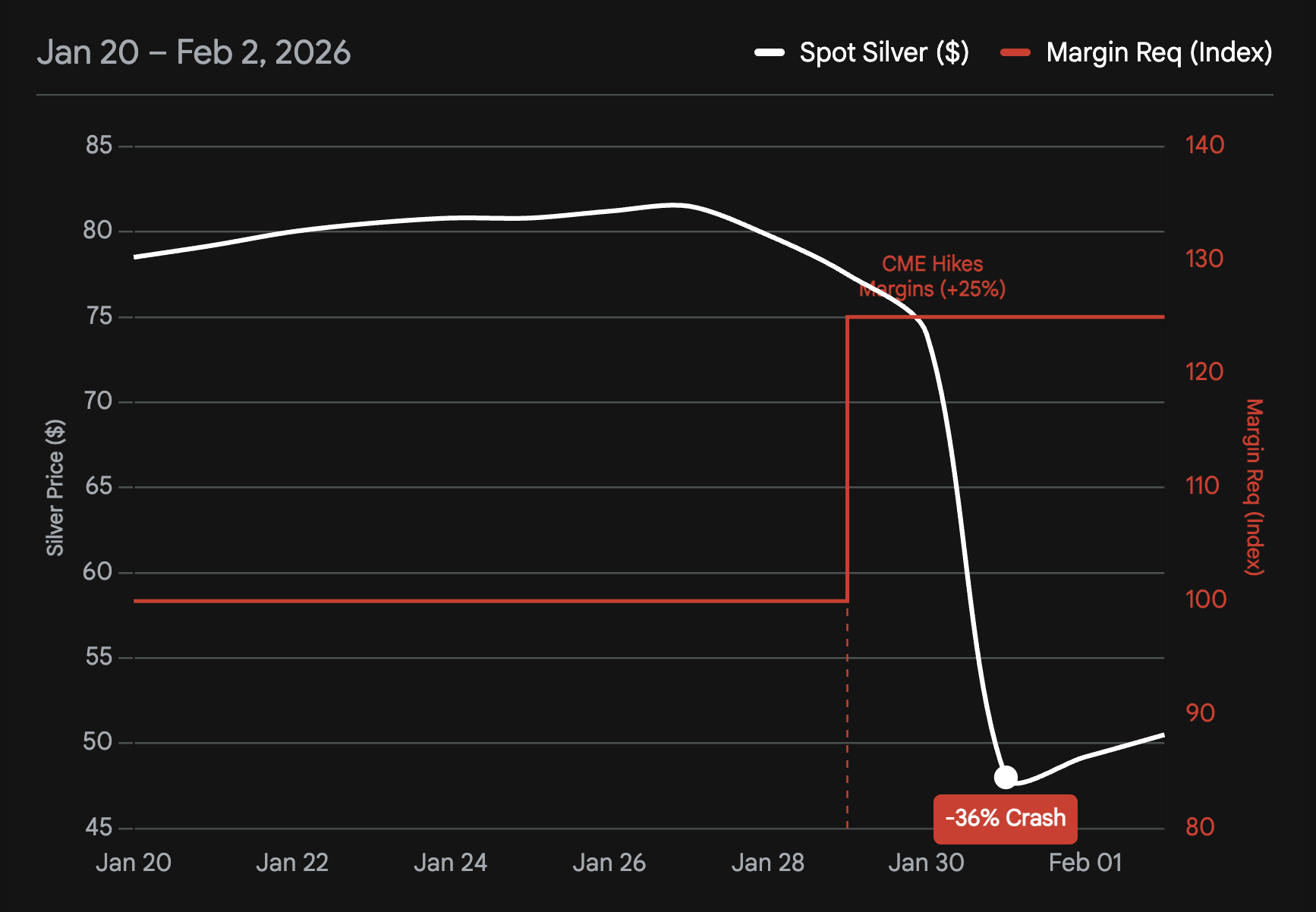

This announcement triggered a massive repricing of the "Debasement Trade." Assets that thrive on currency debasement, Gold, Silver, and Bitcoin, collapsed. Gold fell ~11%, and Silver crashed ~36% in a single session.This synchronization of losses across uncorrelated assets (Tech and Gold falling together) is the definitive signature of a liquidity crisis driven by margin calls.

The unwinding of a carry trade is not a monolithic event; it is a cascade that ripples outward from the most liquid and speculative assets to the core holdings of institutional portfolios. The sequence of asset price collapses observed from October 2025 to January 2026 follows this classic liquidation hierarchy perfectly.

As noted, the unwind began in the crypto markets. Japan is home to a massive retail crypto trading base, and the Yen is a major pair for Bitcoin trading. Snippets indicate that Japanese traders began selling off Bitcoin in October 2025.

This timing is crucial. It correlates with the period when the BOJ began signaling the December rate hike. Retail traders, facing higher mortgage rates and loan costs in Japan, likely liquidated their most volatile, liquid asset first to raise cash. The selling was exacerbated by the looming tax reform in Japan. While the proposal to move to a flat 20% tax rate is bullish in the long term, the immediate pressure of rising funding costs forced traders to sell before the tax cut could be realized.By January 31, massive outflows from Bitcoin ETFs ($528 million) coincided with the broader market crash, confirming that crypto was being used as a source of liquidity to cover losses elsewhere.

Consider the "painful ~3% dump" in the Nasdaq and Microsoft's staggering 15% drop. On January 29, 2026, Microsoft reported earnings. Despite beating revenue estimates ($81.27 billion vs. $80.28 billion), the stock plummeted ~11-15% intraday.

The street blamed concerns over "AI CapEx", the idea that Microsoft was spending billions on data centers with slow return on investment. However, a 15% drop in a $3 trillion company on a "good" earnings beat is rarely fundamental; it is mechanical. Microsoft is a quintessential "momentum" stock, heavily held by foreign institutional investors, including Japanese pension funds. When the Yen strengthens, the value of these USD-denominated assets falls in JPY terms.

If a Japanese insurer holds Microsoft unhedged, a falling USD/JPY exchange rate hurts their balance sheet. If they hold it hedged (rolling short USD positions), the rising U.S. rates (driven by the Warsh nomination) make the hedge prohibitively expensive. The January 29 drop was likely exacerbated by a "stop-loss" cascade from Tokyo desks. As the price broke key technical levels, algorithms programmed to protect Yen-denominated returns indiscriminately sold the most liquid blocks. Microsoft, being one of the most liquid stocks in the world, became the ATM for the rest of the portfolio.

The most compelling evidence of a forced liquidation event is the behavior of Gold and Silver on January 31, 2026. Gold fell ~11-12% and Silver crashed ~31-36% in a single session. Historically, Gold acts as a safe haven during equity market turmoil. If the Nasdaq is crashing due to "Greenland" fears, Gold should rally. Instead, it crashed.

This anomaly can be explained by two factors:

The Warsh Effect: As discussed, Warsh's nomination strengthened the USD and undermined the thesis for holding anti-fiat assets.

Margin Call Dynamics: Snippets reveal that CME Group and the Shanghai Gold Exchange raised margin requirements on gold and silver futures days before the crash.When Japanese traders faced losses on their Microsoft longs and their Yen shorts, they needed cash immediately. They couldn't sell illiquid bonds quickly enough, so they sold their "winners." Gold had rallied to ~$5,400/oz prior to the crash. Traders liquidated their profitable Gold positions to pay for the margin calls on their losing Tech and Yen positions.

Cross-Asset Correlations (Week Ending Jan 31, 2026)

Data sources:

Alex Lexington,

Finance Magnates,

Morningstar,

Investing.com,

Seeking Alpha

This correlation breakdown is visualized in Figure 2, where the correlation between Gold and the Nasdaq 100 spikes to nearly 1.0 during the crash week, a statistical anomaly that only occurs during severe liquidity events.

The "Yen Whale" hypothesis is strongly supported by the data on futures volumes and repo market stress. The "central mystery" is not just in the price action, but in the unseen flows of the derivatives market.

About a week ago, some whale kicked off an astronomically large

market order for a /6J long when it hit all-time lows. /6J (CME Yen

Futures) hit a low of ~0.00647 (approximately 154.50 USD/JPY) in late

January. This level has historically been a "line in the sand" for the

Japanese Ministry of Finance (MOF).

CME reported record volumes in FX and Interest Rate products for January 2026.The aggressive buying off the lows suggests a massive repatriation flow. Who is the Whale? Two theories emerge:

The MOF Thesis: The Ministry of Finance has a history of stealth intervention. Buying /6J (Long Yen) is functionally equivalent to selling USD reserves. Buying futures allows them to support the currency without immediately depleting cash reserves, squeezing speculators who are short.

The Carry Unwind: A massive hedge fund or bank (like Norinchukin) realizing that the "game is up" and closing out short-Yen positions. The size of the order suggests an entity that needed to move billions, not millions.

The subsequent price action, a sharp rally followed by "hammering back down", represents the battleground. U.S. macro funds are still trying to short the Yen (betting on U.S. economic exceptionalism and Warsh's policies), while Japanese domestic accounts are buying it. The volatility is the result of these tectonic plates grinding against each other.

The plumbing of the U.S. financial system showed signs of stress that coincided with the Japanese retreat. The Overnight Reverse Repo facility (ON RRP) saw a year-end spike to $106 billion but has since drained.

Japanese banks are typically huge participants in the U.S. repo market to fund their dollar assets. As Norinchukin and others retreat (repatriating funds to Japan), liquidity in the U.S. repo market becomes thinner. The "air pocket" in Microsoft and Gold prices was likely exacerbated by a lack of market maker depth in the repo-funded derivatives market. When market makers cannot access cheap repo funding, they widen spreads and reduce liquidity provision, leading to "gaps" in price action during sell-offs.

There have been significant moves in other currency futures as well: /6A increased 87 basis points, /6L rose 19 basis points, and /6S rose 18 basis points.

/6A (Australian Dollar): The 87 basis point rise in the Aussie Dollar is notable. AUD is often a proxy for Chinese growth and global risk sentiment. A rise here, amidst a tech crash, suggests a rotation out of U.S. assets and into commodities or Asia-Pacific currencies, further supporting the "Sell America" thesis triggered by the Greenland tariff threats.

/6L (Brazilian Real) and /6S (Swiss Franc): The rise in the Swiss Franc (a classic safe haven) aligns with the risk-off sentiment. The move in the Brazilian Real suggests that emerging markets are also seeing volatile flows as the dollar stabilizes.

Why was the VIX at 16 despite the chaos? The VIX measures implied volatility of S&P 500 options. Its relatively low level (16) compared to the violence in individual names (MSFT -15%, Gold -11%) indicates that the crash is a de-leveraging event, not a panic event.

In a panic, investors buy Puts on the index to protect themselves, spiking the VIX. In a de-leveraging event, investors simply sell the underlying assets (stocks, gold, crypto) to raise cash. They are not hedging; they are exiting. This explains why the VIX remained subdued while prices collapsed, the selling was orderly, algorithmic, and relentless, rather than emotional and panicked.

Skepticism about the "Greenland War" is well-founded. While the diplomatic row was real, its utility as a financial narrative was far greater than its geopolitical reality.

President Trump's threat of military force was retracted on January 21 at Davos.This "de-escalation" should theoretically have calmed markets. Instead, the volatility worsened into month-end. This confirms that the real problem wasn't Greenland; it was the re-pricing of the Yen.

The financial media loves a simple cause-and-effect narrative. "Stocks down because of War" is easy to digest. "Stocks down because the cross-currency basis swap spread widened due to BOJ minutes" is not. The "Greenland" narrative provided the perfect cover for sophisticated actors to liquidate positions in Gold and Tech under the guise of "war jitters." This allowed them to exit without sparking a broader panic about liquidity in the banking system. The focus on the Arctic masked the structural rot in the leverage complex.

The evidence suggests a covert, structural unwinding of the Yen carry trade is the primary driver of the January 2026 market chaos.

The interconnectedness of these events is undeniable. The BOJ's rate hike in December 2025 and the subsequent hawkish signaling from the Takaichi administration fundamentally altered the cost of capital for the world's largest carry trade. The "Greenland Crisis" acted as the initial volatility trigger, forcing a reduction in gross exposure. The nomination of Kevin Warsh acted as the final catalyst, shattering the "Debasement Trade" and forcing a liquidation of precious metals and crypto to cover margin calls on Yen-funded positions.

Here are some key takeaways:

The "Free Money" Era is Over: BOJ policies have fundamentally altered the global cost of capital. The flow of liquidity from Tokyo to New York has reversed.

Geopolitics as Catalyst: "Greenland" may have been the spark, but the Yen leverage was the powder keg. The tariff threats disrupted the "Atlantic Trade" narrative, forcing a repatriation of capital.

Liquidity Event: The synchronized crash of Gold, Crypto, and Tech confirms a systemic de-leveraging. The "Whale" orders in Yen futures and the breakdown of correlations are the smoking guns of a margin-driven event.

With the Japanese election on February 8 and U.S. tariffs looming, the "hammering" of the Yen is likely temporary. The structural trend is now toward repatriation. This implies lower U.S. asset prices, higher U.S. yields, and a stronger Yen over the medium term. The "mystery" of the low VIX is explained by the mechanical nature of the unwind, a controlled demolition of leverage rather than a chaotic panic.

This won't just be the big one. This could be the last one. If you've been preparing your whole life, knowing that something's coming, then this could be the thing you've been preparing for. One final opportunity to get the guys who did this.

Longing the Yen is commonly referred to as "The Widowmaker Trade" on Wall Street, because you have trillions of dollars of monopoly money working against you. The carry traders have compromised every level of our government. Their greatest vulnerability is the Yen rising in value. They will do anything to defend their positions, even if that means bringing America's economy down with them. Since recent events have made it obvious they're going to lose, we might as well fight them. Most of us probably won't make it out of this fight. But if we at least try, then there's a chance we might prosper when it's over.

The IV on OTM CME /6J futures calls is 11% which is astonishingly low. The same is true for calls on the FXY ETF. Call options have defined risk. The more Yen we control, the more its value goes up, and the more crooks on Wall Street get liquidated. The worst that can happen is you lose your monopoly money, but that's been happening anyway. Since carry traders own 10% of all U.S. treasuries, when they get liquidated they'll have to sell a lot of treasury bonds, which means that CME /UB futures and the TLT ETF will fall.

This blog is brought to you by various radicals, malcontents, and people who think the system is rigged. We're not affiliated with any organization. Nothing here constitutes financial advice. Occupy Wall Street is not your financial advisor or your lawyer. We're retail investors like you. Do your own research. Past performance does not guarantee future results. We are the 99 percent. The only solution is world revolution. Wall Street's time has finally come.